The AR/VR market is getting a lot of attention with new product announcements from last week’s Consumer Electronics Show (CES).

Even though the use of XR technologies (covering augmented, mixed, and virtual reality) is still in its early stages, companies making hardware are working to make it more widely accepted by businesses and consumers. At CES, they introduced new mixed-reality headsets, smart glasses, and a Qualcomm processor that will be used in new hardware coming later this year.

“Announcements at CES and in general in this space will help spur the market and innovation required to create a comprehensive ecosystem, which will help the industry evolve (and increase adoption),” said Tuong Nguyen, director analyst at Gartner.

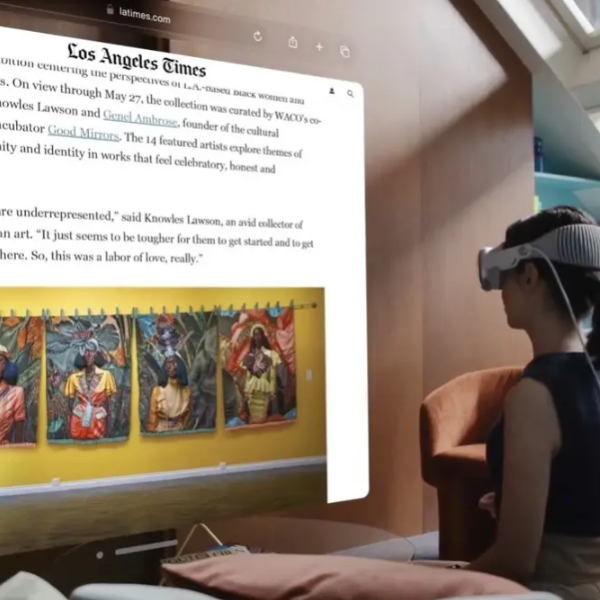

After a backlash against the metaverse and related technologies in recent years, the mood appears to have shifted, starting with the first unveiling of Apple’s Vision Pro last summer. (The headset will be available for pre-order on Friday and hits stores on Feb. 2.) In addition, Meta’s Quest 3 headset and Ray-Ban smartglasses have garnered largely positive reviews, reigniting public interest in virtual- and mixed- reality devices.

That follows a tough 2023 for the market: device shipments declined 8.3% to 8.1 million devices — a small number relative to the money invested in product development, according to a recent report from IDC. However, a sales rebound is predicted during 2024, IDC analysts say, up 46% compared to last year.

“We’re still very far from mainstream adoption,” said Nguyen, with low single-digit percentage adoption for VR and AR headsets currently. Addressing hardware limitations is just one part of the puzzle here. The challenge for progress towards the early majority (let alone mainstream) is the underlying ecosystem of content, services, and applications.

The good news for the industry, he said, is that the devices now coming to market can “spur interest and innovation” in the wider ecosystem. “In turn, this helps the industry evolve,” Nguyen said.

Apple sets a date for Vision Pro

The biggest AR/VR announcements during CES were not at the event itself. Though Apple announced the release date for its long-awaited Vision Pro in the US, no such date has been set for other countries. The device is expected to come to a handful of other markets, including the UK and Canada, later in the year.

“By far, the most significant announcement in recent months is Apple’s Vision Pro announcement,” said Nguyen. “Apple’s validation of the market has and will continue to usher in competitors as well as other critical providers to the ecosystem that needs to establish and grow to make AR and VR HMDs [head-mounted displays] successful.”

With a $3,499 price tag, the Vision Pro isn’t aimed at a mass audience; IDC analysts predict around 200,000 unit sales this year, with business customers likely to be the primary audience at first. According to a CNBC report last week, another analyst expects Apple will quickly sell out of a first run of around 60,000 to 80,000 devices.

The excitement created by Apple’s entry into the market will influence consumer interest in spatial computing—Apple’s term for mixed reality technology—more broadly.

“Apple’s move into spatial computing has energized the market, providing a goal for competitors to aim for or avoid,” said Avi Greengart, president and lead analyst at Techsponential.

“No one has announced a directly comparable product coming to the market this year, but some are clearly in development. Other companies are intentionally taking different development paths or targeting specific market niches to avoid directly competing with Apple.”

Sony unveils unnamed device for 3D content creation

Until now, Sony focused on virtual reality (VR) for gaming, but that’s changing in 2024. At CES, the company revealed plans to target business users with an unnamed mixed-reality device. This device is designed for creating 3D content and collaboration among professionals in fields like entertainment and engineering. Sony also announced a partnership with Siemens to develop industrial augmented reality (AR) and VR services.

The standalone headset has a 4K OLED display and video passthrough similar to Meta’s Quest 3 and Apple’s Vision Pro. The Sony device uses two controllers for interacting with 3D objects in virtual environments: a pointer and a ring controller for manipulating 3D objects while having access to a physical keyboard.

According to Sony, the device is set to be released later in 2024. As reported by ZDnet, the headset won’t be sold as a standalone device. Instead, it will be offered as a package along with Siemens NX Immersive Designer software, which was also announced at CES.

The latest Qualcomm XR chip points to the upcoming Samsung headset launch

The Sony headset will use the latest Qualcomm chipset designed for virtual and mixed-reality hardware, the Snapdragon XR2+ Gen 2. Qualcomm unveiled this processor officially, claiming it will power the next generation of headsets, a week before CES.

The improvements include support for high-resolution displays up to 4.3k pixels per eye (an increase from 3k with the XR2 Gen 2 chip), support for 12 concurrent cameras (two more than its predecessor), and 12-millisecond latency in full-color passthrough—a crucial feature for mixed-reality devices. These upgrades align Qualcomm’s specs closely with the Vision Pro, according to CCS Insight analyst Leo Gebbie, offering a preview of what to expect from the Snapdragon XR2+ Gen 2 later this year.

Qualcomm’s chip is expected to be used in a new headset developed by Samsung in collaboration with Google to build a mixed-reality platform. These plans, revealed in early 2023, were reportedly paused after Apple announced the Vision Pro.

The announcement that Samsung is working with the Snapdragon XR2+ Gen 2 suggests the company is developing a robust standalone headset for launch. The exact timing is unknown, but late 2024 appears to be the most likely window, according to Gebbie.

The cost of devices using the new Qualcomm chipset is currently unknown, but there is a good chance they might be more affordable, according to Gebbie.

Smartglasses get vendor push at CES

Several augmented reality smartglasses were showcased at CES, such as Xreal’s Air 2 Ultra and TCL’s RayNeo X2 Lite, mentioned Gebbie. The Air 2 Ultra glasses, priced at $699, are mainly targeted at developers but will be accessible to consumers when they release in March.

The Wayfarer-style titanium glasses, weighing 80g, provide a lightweight option compared to heavier headsets. The Air 2 Ultra allows users to see digital objects overlaid on the real world, including a large virtual monitor, and spatial videos created on iPhones. However, due to its small form-factor, unlike the Vision Pro and Quest 3, the Xreal Air 2 Ultra needs to be connected to a smartphone, laptop, or PC using a USB-C cable.

The launch of the Air 2 Ultra establishes a “good, better, best” lineup of products for the leading supplier of AR headsets in the market, according to Anshel Sag, principal analyst at Moor Insights and Strategy. While most of its products have 3 degrees of freedom (indicating the number of rotational axes), he noted that the Air 2 Ultras signify the company’s return to 6 degrees of freedom, a feature it had abandoned since the Nreal Light launched in 2019.

“[Xreal] believes there’s a market for it and can attract customers to upgrade to 6 degrees of freedom from its less expensive product,” Sag stated. (Xreal was previously known as Nreal.)

“Xreal began with basic wearable displays and is now enhancing the computing capabilities,” Greengart explained. “The field of view is somewhat limited, and the software ecosystem needs further development, but the hand tracking worked well, and the image quality in my demo was excellent.”